Helpful Information

This year, try a conveyancer that helps makes things easier to understand.

Hint: it's Settlers.

Select a topic below to learn more.

Government Fees

When buying property, the government charges fees. Learn more and calculate them here.

GOVERNMENT COSTS & TAXES WHEN BUYING QUEENSLAND PROPERTY

"I'm surprised!" said no-one ever when finding out the government taxes you when you buy a property.

When buying property in Queensland, the Office of State Revenue will apply a tax called Transfer Duty, and the Titles Office will apply a fee to transfer the title deed into the new owners name and register a mortgage if you are borrowing to buy.

The rates of transfer duty vary depending on whether you are an owner occupier, investor or are an overseas buyer, and the titles office fee varies depending on the purchase price.

Your Settlers team will calculate your government charges for you once they have reviewed your contract. In the mean-time though, you can use this guide to get an estimate of the government costs to assist with your pre-transaction budgeting.

Stamp Duty Calculator from calculatorsonline.com.au

Costs For Buyers

In Depth: Tenancy

Learn about Joint Tenants or Tenants in Common for ownership shares on your property title.

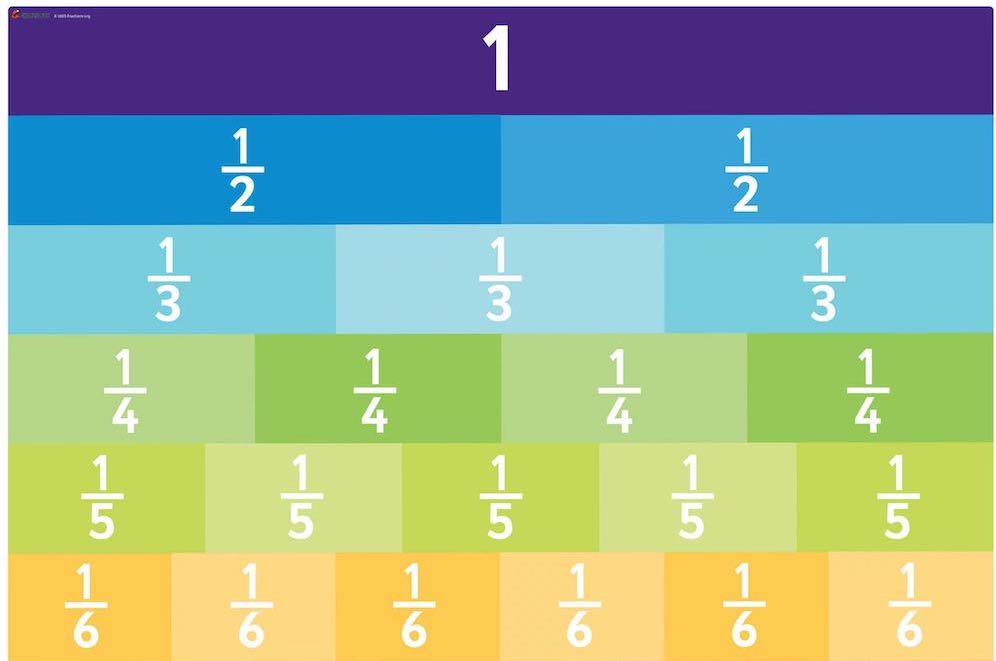

WHAT IS TENANCY?

When there is more than one owner of a property, the law requires that their shares are set out on the title deed. This is known as tenancy. (It is different to and not related with having a tenant or renter in an investment property.)

Recording tenancy on a title deed gives the owners peace of mind that their ownership share is formally recorded, and it gives interested parties readily available proof of your ownership share via a title search with the relevant Titles Office.

There are two main concepts for tenancy that it helps to understand - Joint Tenants and Tenants in Common.

Remember here firstly that tenancy only applies where there is more than one owner, so property owned by just one person or company is not affected by tenancy, as they own 100% of the whole of the property in their own right.

Now, looking at the picture above, you can see the top line marked "1". This shows the concept when a property has just one owner, and it also applies to the tenancy described as "As Joint Tenants".

What Joint Tenants means is that all of the joint owners own the whole of the property together with the other/s. Just as they acquired it as a whole between themselves, so can they only deal with it that way in the future. They do not hold individual shares they deal with independently of the others. A joint tenant cannot sell their share to a third party, nor can they leave it in a will or mortgage it independently to a bank.

The most common scenario this is used for is that when one of the joint owners dies, the other/s automatically (via a simple form) inherit the deceased parties interest, so that the remaining living parties continue on as joint owners of 100% of the property. The property cannot be left in the terms of a will independently to any outside parties. You'll see this the most in cases with husbands and wives/civil partners being shown as Joint Tenants on a title.

Next, Tenants in Common is the opposite of the above, and each persons share can be dealt with independently of the others, So, a Tenant in Common can leave their share of the property to a third party in their will, or they can mortgage only their share to a bank, or indeed they can sell it to someone else independently of the other owners.

Looking at the yellow line in the picture above, you can see in this example where there are six owners of a property who have been recorded as Tenants in Common on the title deed, then each of those six people can deal with their own 1/6 share independently of any of the others.

Tenant in Common shares also do not have to be even, but must always add up in fractions to 1/1 (or the whole) as the lowest common denominator. This covers scenarios where ownership shares are not even.

For example, I may put in 66% of a property's purchase price, John may put in 14%, and Mary the remainder.

In this example, the tenancy would be described as "Tenants in Common in the shares of 66/100, 14/100 and 20/100 respectively" - all of which add up to 100/100, or 1 whole as the lowest common denominator and account for the whole of the property.

If the tenancy has not been correctly recorded on the title in the first instance, then the situation is not easily remedied and may involve payment of additional government transfer duty in some circumstances and further titles office and mortgage fees to update the title.

Settlers will ensure that the title documents are prepared to correctly reflect the intentions of the parties prior to settlement, and save you unnecessary heartache and costly additional expenses down the track.

For Buyers General

Special Conditions Library

A library of property contract special conditions for a range of frequent scenarios.

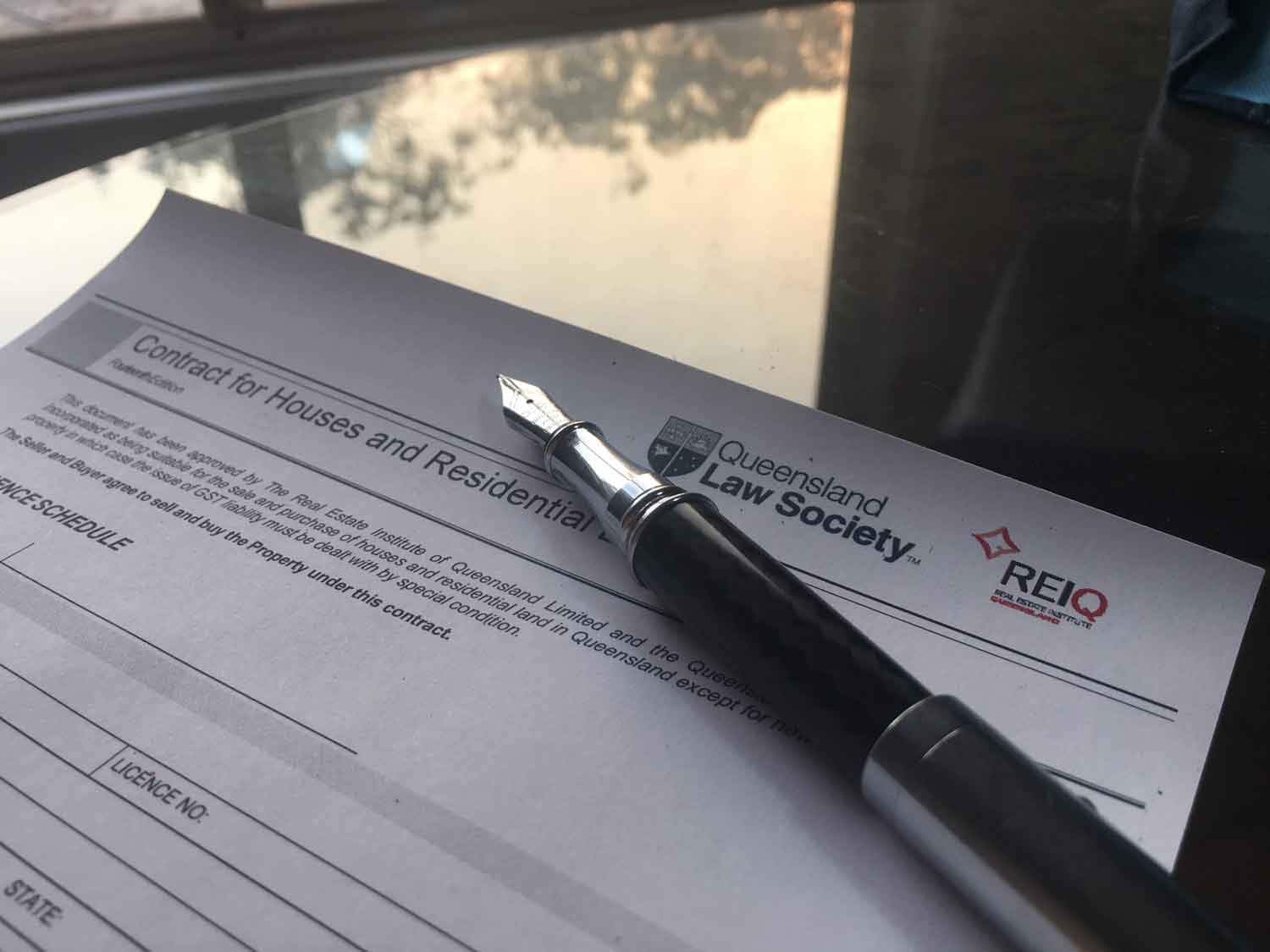

QUEENSLAND REAL ESTATE CONTRACT SPECIAL CONDITIONS

Whilst there is no substitute for specific legal advice on a real-life proposed contract condition or scenario, here you'll find some common scenarios and clauses that may be useful.

Of course, if in doubt, please talk to us first - and don't sign anything until we've reviewed the contract with you.

These special conditions are to be taken as a guide only and clause number references relate to REIQ © House and Land Contract. They may not suit your particular circumstances. You should always seek advice from your legal advisor prior to signing any contract.

-

COVID-19 Comprehensive delay for Coronavirus and Government declarations etcAmending Delay Event Contract Definitionexpand_less

The definition of Delay Event in clause 6.2(8)(b) of the Terms of Contract is deleted and the following is substituted:

“Delay Event means”

a) A tsunami, flood, cyclone, earthquake, bushfire or other act of nature; b) Riot, civil commotion, war, invasion or a terrorist act; c) A Public Health Emergency of International concern or pandemic declared by the World Health Organisation; d) A human bio security emergency or healthy related quarantine or entry and exit restriction declared or imposed by a Government Agency; e) An imminent threat of an event in clauses 6.2(8)(b)a), 6.2(8)(b)b), 6.2(8)(b)c) or 6.2(8)(b)d); or f) Compliance with any lawful direction or order by a Government Agency.

-

COVID-19 Simple delay for Coronavirusexpand_less

- The definition of Delay Event in Standard Condition 6.2(8)(b)(ii) will also include Pandemic.

-

Signing contract via facsimile or emailexpand_less

- This Contract may be entered into by and becomes binding on the parties named in the Contract upon one party signing the Contract that has been signed by the other (or a photocopy, facsimile copy, or a printed electronic copy of that Contract) and transmitting a facsimile copy, or electronic copy of it to the other party or to the other party's agent or solicitor.

-

Solar Panelsexpand_less

- The purchaser acknowledges that there are solar panels installed on the roof of the dwelling constructed on the property hereby sold, and the parties agree as follows:

(a) Whether or not any benefits currently provided to the vendor by agreement with the current energy supplier with respect to feed-in tariffs pass with the sale of this property is a matter for enquiry and confirmation by the purchaser;

(b) The purchaser agrees that they will negotiate with the current energy supplier or an energy supplier of their choice with respect to any feed-in tariffs for the electricity generated or any other benefits provided by the said solar panels and the purchaser shall indemnify and hold harmless the vendor against any claims for any benefits whatsoever with respect to the said solar panels; and

(c) The vendor make no representations or warranties with respect to the solar panels in relation to their condition, state of repair, fitness for the purposes for which they were installed, their in-put to the electricity grid or any benefits arising from any electricity generated by the said solar panels.

-

Due Diligenceexpand_less

- This contract is subject to and conditional upon the buyer(s) carrying out such due diligence inquiries with respect to this property as the buyer(s) shall require within twenty-one (21) days ("the period") from the date hereof. If the buyer(s) are not satisified with the results of those inquiries then the buyer(s) may terminate this contract by notice in writing to the seller(s) or seller(s) solicitors and in that event all deposit monies shall be refunded in full to the buyer(s). If the buyer(s) do not give notice by 5pm on the last day of the period then the seller(s) may terminate this contract by notice in writing to the the buyer(s) or buyer(s) solicitors and in that event all deposit monies shall be refunded in full to the buyer(s).

-

Completion subject to sale by buyer (contract in place)expand_less

- Completion hereof is subject to completion by the buyer of the sale of #property address being the whole of the land comprised in title reference #title reference the contract for the sale of which is dated #contract date . If that sale does not proceed to completion within 90 days of the date hereof then the buyer may either terminate this contract or waive the benefit of this condition. If the buyer fails to terminate or waive this condition by the due date, then the seller may also terminate this contract. Upon termination the buyer will receive a full refund of the deposit paid.

-

Completion subject to sale by buyer (no contract in place)expand_less

- This contract is conditional upon the buyer entering into a contract for the sale of #property address being the whole of the land comprised in title reference #title reference within #number of days days of the contract date, and settlement of that contract within #number of days days of the contract date, failing which the buyer may either terminate this contract or waive the benefit of this condition. If the buyer fails to terminate or waive this condition by the relevant due dates, then the seller may also terminate this contract. Upon termination the buyer will receive a full refund of the deposit paid.

-

Signing on less than 10% depositexpand_less

- Although a full 10% deposit is payable by the buyer the seller has agreed to enter into the contact on the basis that only part of the deposit is paid at the time of the purchaser signing being $ #insert reduced amount to be paid . The balance of the deposit must be paid by the purchaser to the deposit holder as soon as possible as an earnest that the full price will be paid on completion. The full earnest of 10% of the price will be forfeited in the event that the purchaser fails to complete in accordance with the terms hereof.

Note: The full 10% deposit is to be inserted on the front page of the contract.

-

Interdependent Contractsexpand_less

- This contract is interdependent with a contract of even date made between the same parties in relation to the whole of the land comprised in title reference #title reference. It is intended that if for any reason one contract should not proceed to completion then neither will the other. Any breach of either contract by either party shall constitute a breach by that party of the other contract. If either party is entitled to rescind or terminate one contract then they are entitled to rescind or terminate the other contract. Completion of both contracts will take place on the same day and all notices given will be for the same time period and expire on the same day.

-

Seller is the executor and is not yet the registered proprietorexpand_less

- The seller is the executor of the estate of the late registered proprietor. Completion hereof shall take place on the later of 42 days from the date hereof or 14 days after written notice to the buyer that the seller is registered as proprietor. In the event that the seller has not become the registered proprietor of the property within four months of the date hereof then either party may rescind this contract whereupon the deposit will be refunded to the buyer without deduction.

-

Seller remains in possession after completionexpand_less

- Subject to the terms and conditions of the attached licence agreement the buyer will permit the seller to occupy the property from the date of completion until date at a licence fee of $ amount per week.

OR

- Subject to the seller entering into a residential lease agreement the buyer will permit the seller to remain in possession of the property from the date of completion until date at a rental of $ amount per week.

-

Disclosure of unapproved work for statutory warrantyexpand_less

- The seller discloses to the buyer that the seller believes that the works have been carried out at the property without the approval of the responsible council. The buyer acknowledges they are aware of the existence of the works and that the council may not have approved them. The buyer warrants to the seller that the buyer would have entered into this contract even if there is a matter in relation to the works that would justify the making of any upgrading or demolition order in respect of the works by the council. The buyer agrees that they cannot make any objection or claim for compensation nor have any right of rescission or termination by reason only of the facts disclosed in this provision.

The works’ means:

Describe works

-

Completion subject to council approval of structuresexpand_less

Standard conditions 7.6 (1) and (2) are deleted from the contract.

This contract is subject to and conditional upon the buyer receiving confirmation prior to settlement from the local authority that permits have been issued from the local authority for all structures on the property and that all structures have unconditional final approval from it. If;

(a) A permit has not been issued in relation to a structure on the property, or

(b) Unconditional final approval has not been given in respect of all structures on the property,

the seller must obtain the permit/s and/or unconditional approval prior to settlement.

If the seller fails to do so the buyer may terminate this contract, by written notice, at any time prior to settlement in which event the deposit shall be refunded to the buyer without deduction.

-

Subject to Body Corporate approving keeping a petexpand_less

- This contract is subject to and conditional upon the Body Corporate providing written approval within no of days" days from the contract date that the buyer may keep a type of pet* of a maximum weight of weight in the property. Should approval not be obtained by no of days from the contract date the buyer may elect to waive the benefit of this clause or terminate the contract and all deposit monies will be refunded in full. If the buyer has not elected to waive the benefit of this clause or terminate the contract by no of days from the contract date then the seller may elect to terminate this contract and all deposit monies will be refunded to the buyer in full.

-

Subject to termination of an existing prior contractexpand_less

- This contract is subject to and conditional upon the termination of the contract entered into between the seller and buyers names dated date "the prior contract" within no of days days from the date of this contract.

1.1 Should the prior contract not be terminated on or before no of days days from the date of this contract, this contract will be at an end and all deposit monies will be refunded to the buyer in full.

-

Transfer by direction / intermediate buyerexpand_less

- Clause 7.4(1) of the Terms of Contract will not apply to this contract.

1.1 Clause 5.3(1)(b) of the Terms of Contract will not apply to this Contract and will be replaced with the following:

A Transfer by Third Party Intermediate Purchaser (Transfer by Direction), stamped and executed by the current registered owners of the lot (and if required by the Registrar of Titles, also executed by the Seller) in favour of the Buyers capable of immediate registration in the appropriate Government office free from encumbrances (other than those set out in this Contract) but subject to the conditions of this Contract, and other documents capable of allowing the Buyer to become the registered owner of the lot including an undertaking from the Seller to answer any requisitions and pay for the costs of answering any requisitions that may issue from the Registrar of Titles or the Office of State Revenue in relation to the Transfer by Direction.

-

Deposit by way of Deposit Bond or Bank Guaranteeexpand_less

The seller(s) agree with the buyer(s) that the deposit or any part of the deposit payable pursuant to this contract may be satisfied by the buyer(s) by providing the original copy of a deposit bond or bank guarantee to the stakeholder by the due date for payment of the deposit. Such Deposit Bond or Bank Guarantee shall be issued by a reputable company carrying on the business as an originator of deposit bonds or guarantees in Australia.

The Stakeholder may make demand on the Issuer of the Deposit Bond or Bank Guarantee for payment of the sum guaranteed in any circumstances in which the seller(s) is/are entitled to forfeit the deposit monies under this contract at which time the Stakeholder will deal with the monies received from the Issuer of the Deposit Bond or Bank Guarantee in accordance with the terms of this contract.

On the Completion Date the Buyer will pay the purchase price or balance thereof if some cash deposit is held by the stakeholder by way of bank cheque, subject to the adjustment as set out in this contract and return of the original Deposit Bond or Bank Guarantee to the Buyer.

These special conditions are to be taken as a guide only. They may not suit your particular circumstances. You should always seek advice from your legal advisor prior to signing any contract

Contracts For Sellers For Buyers

Glossary of Key Words

Learn about words and terms you'll come across when buying or selling property in Queensland.

A

- Agent - Acts on behalf of sellers to arrange the sale of property.

B

Body corporate - a legal entity which is created when land is subdivided and registered to establish a community titles scheme. All of the owners in a community titles scheme are automatically members of the body corporate when they buy their lot. Also known as strata titles in other states.

Boundary - Based on a survey or registered plan which defines and shows the boundaries of the property.

Building and pest condition - the clause in the contract that allows a buyer to terminate a contract and get the deposit back in full if their building and pest inspection is not satisfactory.

Buyer - the person or entity buying the property, also known as the Purchaser as listed on a Contract of Sale, and the Transferee as listed on Titles Office documents.

C

Certificate of title - A certificate of title provides official proof of ownership of land. Historically issued on paper, now they are a paperless electronic record.

Chattels - Freestanding movable items are called chattels and they can be included in a sale; however, they must be noted in the contract of sale. Pool and spa equipment, potted plants and washing machines are good examples of chattels and should be disclosed separately on the contract of sale if they are included in the sale.

Common property - The areas of a registered strata plan/body corporate complex that are for shared use and access by all owners (e.g. hallways, green spaces and can include courtyards, driveways, car parks in unit blocks).

Community titles scheme - A community titles scheme allow you to privately own an area of land or part of a building, as well as share common property and facilities with other owners and occupiers in a body corporate or unit complex.

Concession - A reduction in the amount of duty you must pay on certain dutiable transactions. Transfer duty concessions are available to home buyers, first home buyers and buyers of vacant land on which to build their first home. Concessions also exist for superannuation, certain family business transfers and certain investment schemes.

Consideration - generally, the Australian dollar value paid for property in property transfers. Consideration includes monetary and non-monetary payments, such as assumption of liabilities.

Conveyancer - in Queensland, a paralegal or clerk who works for a law firm doing conveyancing under the supervision of a solicitor.

Conveyancing - the formal process of transferring legal ownership of real property (land) from one person or entity to another.

Cooling-off period - a specified number of days during which the buyer can elect not to proceed with a standard purchase contract. In Queensland, this period is 5 days and ends at 5.00pm on the 5th day after the buyer received a copy of the contract signed by the seller.

Contract of sale - a legally binding agreement between the buyer and the seller for the sale of real property that provides for all of the agreed aspects, property details, rights and obligations between the two parties.

D

Disbursements - additional costs on top of the conveyancer's professional fee (the labour part) that are incurred as part of the conveyancing process. They can include title and council searches, agent fees, government charges, registering the title transfer, or even something as simple as photocopying. Also called outlays.

Dispose - for transfer duty, relating to land or a residence, means transferring, leasing or otherwise granting exclusive possession of part or all of the property to another person. This may include selling the property or renting out one or more rooms. Disposing of the property within certain time frames can result in any concessional duty originally claimed having to be repaid.

E

Easement - a covenant that burdens or benefits a parcel of land. Easements can affect what you can or cannot do with the land. An example of an easement is a right of way over someone else’s land.

Encumbrance - Mortgages, security interests like caveats or other charges and liabilities that are or can be attached to a property.

F

Finance condition - the clause in the contract that allows a buyer to terminate the contract and get the deposit back in full if they are not successful in obtaining finance from a lender.

Fixtures - fixtures are defined as anything on the property that is ‘screwed in’, ‘glued on’, ‘nailed on’, ‘bolted on’, or ‘plumbed in’ to the structures of the property and are included with the sale. An under-bench plumbed-in dishwasher is a fixture; a mobile one temporarily attached to a counter-top tap is not. Typical fixtures include stoves, hot water systems, fixed carpets, clothes lines, television antennae, in-ground plants and trees, ceiling fans, mailboxes, built in air-conditioning or heating systems

Freehold - permanent and absolute tenure of land or property with freedom to dispose of it at will. In Australia, freehold property title is also known as Torrens title, a land registry system named after Robert Richard Torrens who introduced freehold ownership in South Australia in 1958. In Queensland, this system is administered under the ATS (Automated Title System).

J

- Joint tenants - Joint tenants means that each tenant (for example a husband and wife) own the whole of the property together or jointly. This involves a right of survivorship, that is, the interest of a deceased joint tenant passes to the surviving joint tenant, so that in the example of the husband and wife, the surviving spouse then owns the whole of the property on their own.

L

Lot and plan number - every property will have a lot and plan description. These are stated in the property section of your contract. Most councils include the lot and plan on rates notices. You can also use the Queensland Geocoder to find this information.

Lot entitlement - in body corporate community titles schemes set out each owner’s body corporate costs and voting rights, share of common property and other assets and lot value for calculating government rates and other charges. Lot entitlements are set by the original owner (the developer) when the community titles scheme is established. Lot entitlement schedules for a community titles scheme are recorded in the community management statement.

O

Off-the-plan - a residential off-the-plan purchase occurs when a person enters into a contract to purchase new residential property before construction is completed. An off-the-plan purchase generally involves a proposed lot where the title is yet to be registered. Settlement of the contract cannot occur until certain events have happened (e.g. where the owner of the land has not completed all capital works required before the title can issue, such as boundaries, roads, and telephone and electricity connections; or where an apartment block is being built).

Outlays - additional costs on top of the conveyancer's professional fee (the labour part) that are incurred as part of the conveyancing process. They can include title and council searches, agent fees, government charges, registering the title transfer, or even something as simple as photocopying. Also called disbursements.

P

Personal property - ‘personal’ property encompasses tangible or ‘corporeal’ things—chattels or goods, and certain intangible or ‘incorporeal’ legal rights such as copyright or intellectual property.

Principal place of residence - A residence you live in (with your personal belongings) on a daily basis.

R

- Real Property - ‘real’ property is generally concerned with the law relating to interests in land and buildings on the land (e.g. houses, apartments, business premises or vacant land). Real property is property that can be registered with the Land Titles Office.

S

Settlement - the event when contract conditions have been satisfied and the balance of the purchase price is paid to the seller and the documents required to legally transfer of ownership are exchanged and subsequently registered or sent for registration. This can be performed physically, or electronically.

Stamp duty - now known as transfer duty, it is a State-based tax that is paid on certain land or business transactions. The costs vary depending on value of the transfer (consideration) and whether it is a principal place of residence (owner occupier) or an investment property, and is paid by the buyer of the land.

T

Tenants in common - A form of joint ownership of a property when each person owns a share of the property, equally or unequally. It is different to joint tenants as each tenant owns a particular portion of the property (eg. 40%, 50%, 60% etc) and may be able to transfer their portion only or give to a particular person through their Will. The right of survivorship does not apply to tenants in common as it does for joint tenants.

Time is of the essence - particularly a feature of Queensland property contracts, it's a contractual term that requires timely completion of a specified task. If timely completion of the task does not occur by the due date, then the other party to the contract will have rights against the defaulting party - including possible termination of the contract, forfeiting the deposit and suing for costs.

Transfer duty - formerly known as stamp duty, it is a State-based tax that is paid on certain land or business transactions. The costs vary depending on value of the transfer (consideration) and whether it is a principal place of residence (owner occupier) or an investment property, and is paid by the buyer of the land.

Transferee - the party obtaining the interest. Also known as buyer, purchaser.

Transferor - the party disposing of the interest. Also known as seller, vendor.

U

- Unencumbered - free of any encumbrance, also called a clear title - i.e. no mortgages, caveats or charges are registered against the property.

V

- Vendor - the person or entity selling the property. Usually referred to as the Seller on the Contract of Sale, and the Transferor as listed on Titles Office documents

Z

- Zoning - The permissible uses of an area of land as stipulated by the Local Council.

General

Verification of Identity

Legislation requires buyers and sellers of property to have their identity verified. Learn how.

VERIFICATION OF IDENTITY

Verification of Identity (VOI) is a relatively new requirement for all buyers and sellers or property, along with dealing with mortgages, that came about in line with e-Conveyancing and was introduced to help prevent fraud, both financial and title deed related.

The identification process supports the requirements of e-Conveyancing and the various Titles Offices requirements for lodging transfers in title, mortgages or releases of mortgages and involves a strict identification regime to be completed, or to have been completed in the preceding two years before the property transaction.

It requires an in-person, face-to-face meeting or remote technology assisted service with an identity verification agent, of which there are a few different options available:

Your conveyancer will give you more information, but the options include arranging your own via AusPost (you go to a post office) or ZipID (they come to you) for paper based settlements, or having your conveyancer book Infotrack (our preferred option as it's all completed remotely) to arrange completion of VOI and the signing of e-Conveyancing authorities with you.

There is a set identity standard that has to be followed, and starts with providing a current passport and driver licence (or state issued proof of age card). There are other categories of further documents required if only one of the prior types of primary ID is available, such as passport or driver licence along with birth certificate plus medicare or pension card.

Fees vary provider-to-provider and time-to-time with promotions, but are around $50 per person at AusPost, to around $60-$100 per person via ZipID depending on your location at the time of writing. Our recommended service through Infotrack is $165.00 for all parties, can be conducted from anywhere with your mobile phone, tablet or computer and includes e-Conveyancing authorisations if your matter is to settle through PEXA e-Conveyancing.

General For Sellers For Buyers

E-conveyancing (PEXA)

Learn about e-conveyancing and what it means for buyers and sellers.

E-CONVEYANCING

Background

e-Conveyancing came about from a commitment at the 2010 Council of Australian Governments (COAG) meeting to deliver a single, national e-Conveyancing solution to the Australian property industry.

It took a while to get there, but e-Conveyancing is now up-and-running for many types or property settlements.

Formed by the four major banks (CBA, ANZ, NAB, WBC), the Victorian, NSW, Qld and WA Government Titles Offices, and three private investors (Macquarie Capital, Little Group, Link Group), PEXA then became the first provider of an e-Conveyancing service. PEXA's regulatory framework was, amongst other things, to create a FOR PROFIT organisation, and to list on the stock exchange. Sympli, a second provider on the e-Conveyancing platform, has also commenced providing electronic settlement services to its users.

These operators are called 'ELNOs' (electronic lodgement network operators), and they compete for customers to use their systems to complete an e-Conveyance.

You may hear people refer to e-Conveyancing generically as 'PEXA', but that is not technically correct. As mentioned above, PEXA is just one operator (ELNO) that provides access to users (buyers/sellers/financiers) of the e-Conveyancing network, and the provider space will increase and allow for more competition over time.

The system is intended to replace the paper based financial settlement aspect and subsequent lodging of title transfer documents digitally.

Its challenge is to develop an online system that retains the integrity of the existing tried and tested traditional paper one.

Benefits

- Same day financial settlement

- Same day lodging and registration of transfer documents

- Multiple settlements can be processed

Risks

- Delays by system failures - contract conditions allow automatic extension, paper based allows imposing conditions, termination

- Withdrawal of party - 5 days notice and reversion to paper based, puts other party at risk if not prepared with both methods - extra costs and risks of default

- Immediate Transfer of Funds - error in account number, fraud

- Physical settlement allows for postponement right up to last minute, e-conveyancing does not allow aborting settlement once settlement process has commenced. If issues arise, there are no rights to take any action once the settlement electronic workplace is locked for settlement

Downside

Together with the above risks, the main downside is that additional fees apply for all parties using the system - hence that helps explain its' "FOR PROFIT" model. Each law firm has their opinion on whether it saves as much time as it costs. From the backend, there's still an enormous amount of normal work needed to be done by the conveyancer, plus then keying in and checking all the data in the operator's system. To-date, it has not delivered a reduction in mostly already competitively low conveyancing legal fees. Some outlays like settlement and stamping agent and after settlement banking fees have been balanced out by the ELNOs fee.

Fees

Fees vary by provider and from time-to-time with promotions, but at time of writing, an average fee for a buyer or seller is around $150.00. Your lender will also charge e-Conveyancing fees if there is a mortgage involved, presently $50.00-$60.00 per mortgage. Yes, the fees do add up, especially if there are a few other variables to the transaction. Note that Titles Office fees remain as per normal for paper based transactions and are additional to the ELNOs fees. If you said "hang on, titles office fees should be less because it's all automatic" we wouldn't disagree.

Bottom line

e-Conveyancing is with us and here to stay. The advent of Covid-19, especially, advanced its adoption in the industry so that manual settlements and in-person contacts were avoided.

While the system is still developing, it is working fine for most types of residential contracts, and there are now some anti-fraud insurances built in to address the publicised instances of sellers and buyers losing their money to financial fraud via interception and change of bank account numbers.

If all parties agree to participate, then there's no critical reason not to do your contract via e-conveyancing.

Some developers contracts are making it mandatory, so you may not be given a choice.

At this stage, an e-Conveyance can only be completed by solicitors, conveyancers and the major lenders who are registered to use the system. Private individuals cannot participate on their own behalf.

If you have any questions, please talk to us. We'd be happy to help.

General For Sellers For Buyers

The Contract Deposit

Learn about the deposit on real estate contracts.

QUEENSLAND REAL ESTATE CONTRACT DEPOSITS

BACKGROUND

A deposit is paid by a Buyer on entering into a real estate Contract. It is usual practice on all Contracts as a surety to the Seller that the Buyer is genuine and will proceed with the purchase.

They are designed to cover the Seller should the Buyer be in default of the provisions of the Contract.

The deposit is generally paid to the Real Estate Agent and is held in their trust account until settlement, where it is then paid to the Seller. It makes up part of the purchase price paid by the Buyer, so it is deducted from the purchase price amount the Buyer has to pay at settlement.

There is no legal requirement to pay a deposit on every Contract, however the will Seller usually require that one be paid or they may choose not to sell the property to you and wait for or accept another offer.

If you change your mind and decide not to proceed with the purchase (after the cooling-off period expires) the Seller can keep the deposit. Additionally, the Seller can also claim any losses that the deposit does not cover, such as selling to another Buyer at a lower price and the associated costs incurred in reselling, such as agents costs, advertising and holding costs like lenders fees and interest.

it is vital that you seek legal advice before you enter into a Contract so your individual circumstances can be considered, and that you pay your deposit amounts when due, as failure to pay when due can also leave you liable to the Seller terminating the Contract and becoming entitled to the full deposit you will have forfeited.

INITIAL DEPOSIT

A deposit may be paid in one lump sum or in multiple parts. The initial deposit is the first part (or the whole lump sum) and is usually payable on the Buyer signing the Contract, or a set date after the signing date, such as the next business day after signing.

BALANCE DEPOSIT

The balance of the deposit is usually set on a date when the Contract becomes unconditional, such as satisfaction of the finance and building and pest clauses or within a couple of days of that last event

These dates are a matter for negotiation between the parties, and is usually arranged with the Real Estate Agent.

HOW MUCH SHOULD BE PAID

Deposit amounts vary but are usually between 5 and 10% of the purchase price.

A deposit should not exceed 10% of the purchase price, or unintended legal consequences will arise. For off-the-plan Contracts, the maximum is 20% before it becomes problematic.

Never pay more than 10% without seeking legal advice before you sign a Contract.

TERMINATION OF CONTRACT

If a Contract is terminated by a Buyer acting reasonably under a finance clause or building and pest inspection clause, the deposit is refunded to the Buyer without deduction.

If a Buyer does not act reasonably, the Seller can take action to enforce the Buyer proceeding with the Contract or terminate the Contract and claim the deposit and costs. As an example, if a Buyer terminates under the finance clause, but does actually have an adequate loan approval, this could be construed that the Buyer is not acting reasonably. Likewise a building inspection report listing no issues but terminating under this clause could also be considered unreasonable.

If the Contract is unconditional and a Buyer does not settle on the due date or breaches some other Contract condition, the Buyer will be in default under the Contract and the Seller will be entitled to keep the deposit as a penalty, plus claim additional losses and costs as mentioned earlier.

You should always seek legal advice prior to entering into a Contract so that you understand the deposit conditions, especially if you think that there may be circumstances that may prevent you paying the Balance Deposit or even worse, settling on time.

Contracts For Sellers For Buyers

Want more answers?

If you're the inquisitive type and would like to know more about a particular conveyancing issue, check out our blog page for news and announcements from the conveyancing world.

Have a particular question about Settlers' services? Click the button below and get in touch with us.

Settlers Legal Pty Ltd © All rights reserved. | Terms of Use | Privacy

Individual liability limited by a scheme approved under professional standards legislation.

.png)